THE "BREAKING RULE"

It is critical to establish with maximum accuracy when trend lines or support / resistance levels are "broken". Just doing this correctly will save you thousands of dollars in the long run from avoiding wrong or losing trades. E.g to establish if a trend is reversing before you can enter a trade, it requires you to confirm two "breaks" before you can assume that a possible reversal is in fact in process, i.e. "break" of the trend line itself, and "break" of the previous high / low.

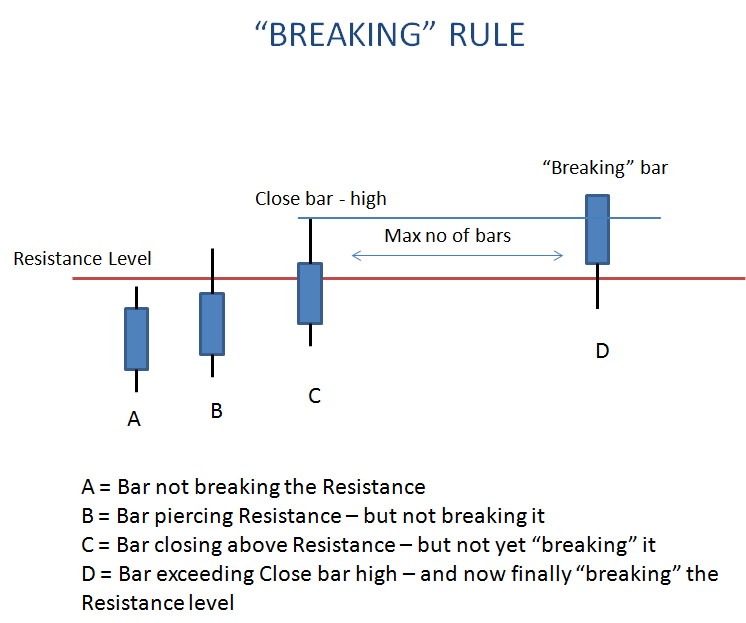

Definition of the "Breaking Rule":

The basic "breaking rule" says that the price must first close above / below the specific line / level that must be broken with at least a few pips, and then the price must later continue - within a specific period of time determined by the trader (measured in number of bars / candlesticks - the sooner the better) - and exceed (does not have to close) the previous high / low of the close bar with a few pips.

Here are some charts illustrating the rule:

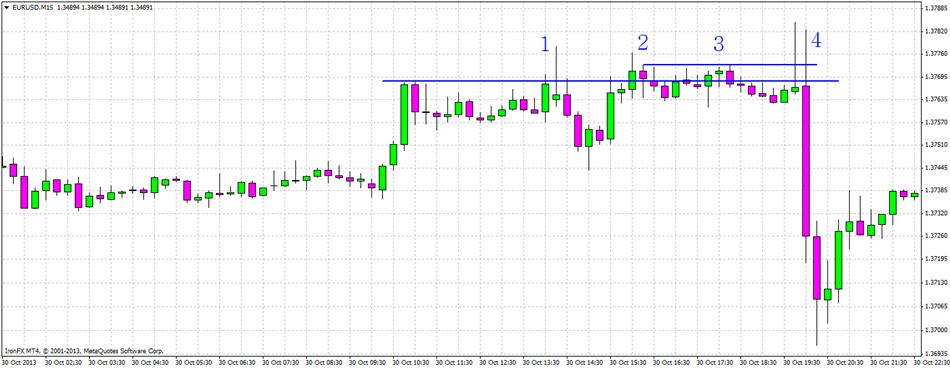

At the chart above we see that a resistance level has formed after the price drifted sideways for a while and then attempted to break a new level.

At no 1 we see some bars piercing this level, but not "breaking" it.

At no 2 we see a bar closing above this level - and we now wait to see of a following bar will "break" this Close bar's high.

Only after a lapse of 15 bars the price is at last exceeding the Close bar high (at no 4), but now it is not valid any more, because of one or more of the following reasons:

1. Either too much time has lapsed dince the Close bar and the trade has been abandoned, or

2. A new Resistance level has been formed after the Close bar (see level at no 3) and now the "breaking rule" should be applied to this new level, before the resistance is broken.

Other important Factors:

1. The number of pips that the price must exceed the level / line and high / low of the Close bar depends on the volatility of the currency pair and should be around 3 pips for low volatility and 5 pips for higher volatility pairs.

2. When the breaking rule is applied to a Support or Resistance level it is only necessary to apply this rule to that particualr level, but

3. When the breaking rule is applied to a trend line, it should be applied to the trend line as in the case of a Support / Resistance level, and in addition the price should also "break" the previous high / low formed by the previous bars to ensure that the trend is over and is now reversing. Sometimes these two "breaks" can take place at the same place and sometimes there are two places the "breaking" rule must be applied to. (See the chart that is shown under the Refresher Course that explains this situation)

E-mail: [email protected]